A sinking fund is a short-term savings account used to make large purchases in the future. Some examples…vet bills, vacations, home maintenance, self-care, new appliances, etc. Sinking funds make it possible for you to pay cash for items you would normally finance and pay interest on. You don’t need to change how much you save per month to start building one. I’ll show you how to continue to build your emergency fund and one sinking fund at the same time without changing how much you save per month.

What Makes Your Credit Score Go Up

Did you know your payment history, credit utilization, and the age of your credit accounts have the biggest impact on your credit score? If you miss a payment your credit score will drop… no surprise there. But if you start paying off your debt you could see a significant increase in your score.

What Causes Lack Of Motivation

Conquer a lack of motivation by getting rid of mental distractions, know your roadblocks, write down your goals, and reward yourself as often…

How To Get Motivated

Part 1: Try to complete the new habit first thing in the morning. This will make sure you always get to it. Part 2: Constantly visualize the positive outcome you will get if you stick to the new habit.

Part 3: Create a more exciting reward system for completing the new habit.

It’ll encourage your brain to make the new habit automatic.

Part 4: Search YouTube, podcast channels, or Ted Talks to find a motivational speaker to listen to once per week.

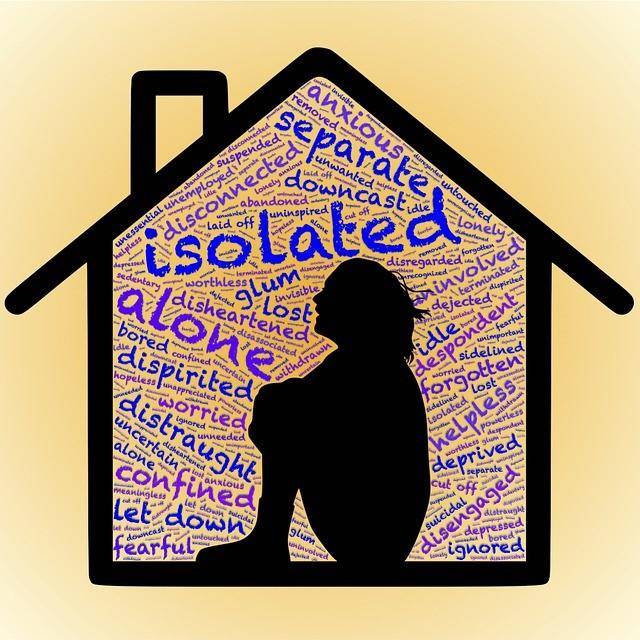

What Is Financial Anxiety and How To Calm It

Financial anxiety is the feeling of stress over spending too much money, worrying about not having enough money, or the stress of losing your job. This type of anxiety is actually common for everyone. The difference is in the severity of it. If you are experiencing loss of sleep, your appetite, unable to concentrate, etc. Keep reading to discover how you can lessen your financial anxiety to find calm at the end of your path.

How To Break A Bad Habit In Your Finances

Do you constantly struggle with a bad habit surrounding your finances? Do you know what you need to do but can’t get started? Your brain is holding you back from correcting your bad habits. This post will teach you how to change the bad habits that are costing you hundreds per month!

What Happens If I Don’t Pay My Credit Card Bill?

I think we have all been there. Lost a job, given fewer work hours, or had to take unpaid time off from work due to an injury. We have all had to make a decision to skip a […]

Does a Student Loan Forbearance Affect My Credit Score

Forbearance on your student loans will not cause a negative or positive effect on your credit score. It is only noted so the credit bureaus are aware you have not defaulted. However, you do need to be aware of how interest, auto-payments, and when the forbearance will all affect your student loans; your future financial […]

What Is Predatory Lending

What is predatory lending? Not enough people are asking this question. This is a financial loan that will destroy your credit history, your financial future, and possibly your life! I’m bringing this up now because COVID 19 is taking an ugly turn in our local communities. When people are not receiving their wages […]

Unemployed & Can’t Pay the Bills?

How many of you are tired of the COVID19 epidemic? Are you unemployed and can’t pay the bills because you work for a small company or are hourly? I wrote this article to help those of you who feel like there is no place to turn. Follow the 8 steps to […]