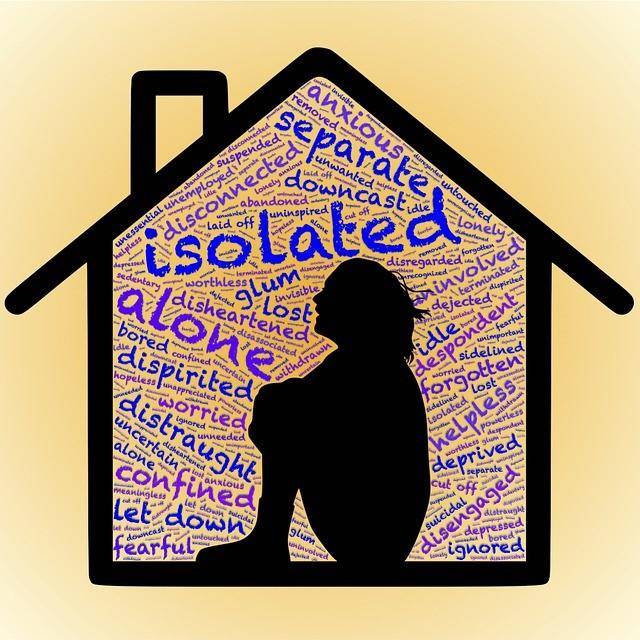

Financial anxiety is the feeling of stress over spending money, not having enough money, or losing your job.

This type of anxiety is actually common for everyone. The difference is in the severity of it. If you are experiencing loss of sleep, your appetite, unable to concentrate, etc.

Keep reading to discover how you can lessen your financial anxiety to find calm at the end of your path.

My Financial Anxiety Story

I remember 2004 as if it was yesterday. I moved into my first apartment. Finally, I was living on my own terms.

At the age of 21, my only work experience was part-time. My income was $800 per month, rent was $500 per month.

After about 6 months of living on my own, my financial anxiety was so high I was having difficulty getting out of bed. I was depressed, scared of not being able to finish my accounting degree, and starving.

Since I made so little I was trying to live off $20 of groceries per month. However, I jumped over this hurdle by finding a full-time job that would not interfere with my schooling.

To most of you, this may seem like an obvious solution to the problem. Nevertheless, as someone who had never worked part time and living on my own for the first time. It took 6 months to find the solution on my own.

Just like in my story above, many of you are at the cusp of discovering a solution to your current financial anxiety.

Do not be like me and keep it all to yourself. The following is everything I wish I knew in 2004.

Financial Anxiety Defined

The basic definition of anxiety itself is the fear, worry, or the feeling of unease about something. A common anxiety people have is toward public speaking.

Some can get shortness of breath, racing heart, butterflies in the stomach, and sweaty palms caused by that anxiety.

Financial anxiety is all of those experiences being felt when it comes to the thought of money. This form of anxiety isn’t just caused by the worry of not having enough money.

Financial anxiety can also be caused by constantly feeling unprepared and not knowing the financial terminology.

It is also possible to experience financial anxiety when you do not have any financial difficulties.

Another extreme to financial anxiety is worrying that someday you could end up in severe debt.

This can cause you to constantly be frugal and behave as if you are in extreme debt.

More Articles You May Be Interested In:

The Ultimate Guide To Budgeting

How a Grocery Price List Can Save You Money

Snowball vs Avalanche Budget Method

How Do I Get Out of Debit With Bad Credit

Financial Anxiety Symptoms to Watch Out For

“Financial anxiety can be debilitating, and it can cause significant distress in one’s daily life.”

says Kristy Archuleta, associate professor of personal finance planning at Kansas State University and co-founding editor of the Journal of Financial Therapy.

How to recognize financial anxiety symptoms

1. Finance induced depression or anxiety

2. The habit of overspending as a way to avoid

3. Obsessed with being frugal in fear of money problems

4. Afraid of gaining wealth

5. Let or expect others to handle your finances (Remember Brittany Murphy’s character in the film “Uptown Girls?”)

6. Can’t seem to change financial behaviors even with a reward system

7. Constantly giving money to struggling relatives or adult children. (This one is reportedly the most common reason people seek out financial advisors for help)

How Do You Calm Financial Anxiety

There are ways to start calming your financial anxiety. Imagine having a life with a plan and a lot less stress.

Find someone to talk about your finances

This does not have to be a professional therapist but they can be if you want them to.

Is there someone currently in your life you can trust with your privacy?

Someone, you tell everything to?

Ask them if they wouldn’t mind being your soundboard to talk through what’s causing your financial anxiety.

This person is not there to solve your problems.

They are there to help you de-escalate your stress.

Holding it in only causes it to get worse. Most of the time if you verbalize a problem it lifts the mental fog to help you find the solution on your own.

Actually look at your finances from last month

It is time to stop avoiding opening your bills, bank statements, taking calls from your creditors, and reviewing credit card statements.

Half the battle of fighting financial anxiety is to know exactly where your finances stand.

Also, look at how much money you earned last month.

This is the map to finding your pirate treasure!

Look at the total amount of what you earned next to the total number of how much you owe.

Some of you may be shocked to find you actually make more money than what your monthly bill payments are.

If you do not make more money than your monthly expenses, then you now have the road map to start figuring out which creditors you can start calling. Ask them if they can put you on a financial hardship plan.

A majority of companies have them but they won’t advertise it. Especially the credit card companies, start asking.

Create your plan of attack

In addition to asking about financial hardship plans, start looking at where you can cut back.

Are you overspending on fun shopping sprees or maybe ordering door dash for every meal?

Try cutting down on this. There are 3 ways to manage money; make more money, lower your monthly spending or both.

I suggest start paying off your smallest debt first and making minimum payments on the rest.

You will be amazed at how much better you will feel when focusing on paying off only one debt at a time.

Create your budget

Ugh, how tired are you of hearing that?

Consider a budget as part of your treasure map. You are looking for hidden money that might be sneaking out somewhere.

The budget is just a list of payments you are expected to pay each month. Try to stick to it and only spend what is listed on it (include gas and food).

You may find you have a little money left over to last you to your next paycheck.

What do you find relaxing?

It is time to start experimenting to find something to relax you without spending money. Then add that to your daily routine. Find something you can complete in 20 minutes to an hour.

Try a short 20-minute walk, meditation, binging Netflix, spending time with your family, taking a warm bath, or sleep in one day per week. I personally like to read and knit.

More Articles You May Be Interested In:

The Ultimate Guide To Budgeting

How a Grocery Price List Can Save You Money

Snowball vs Avalanche Budget Method

How Do I Get Out of Debit With Bad Credit

Your Take Action Guide

I know there were many suggestions and finding a place to start can seem overwhelming.

The following action steps are where I want you to start.

Once you are comfortable with these go back through the, “How do you calm financial anxiety,” section and find a new action step to add to your routine.

1. Create a list of bills you pay every month and what you owe. Look at your:

a) Bank statements

b) Credit card statements

c) Past due bills

d) Bills in collections

2. Create your budget. Don’t forget to include a line for food and gas in your car.

3. What is your smallest debt? Let us try to pay $20 extra per month on that bill while paying the minimums on your other bills.

4. For the bills with too large of a minimum payment call the creditor and ask about a hardship program. Explain your financial difficulty to them.

5. Add a relaxing activity to your daily routine. This is the one time per day you can forget all of your responsibilities; just be you!

6. Find someone in your life to talk about your financial anxiety. If you can verbalize it, you will start letting go.

I agree this list is a challenge. I am asking a lot. However, the sooner you start putting it into action the better your mental health is going to be.

When you are feeling overwhelmed say the following to yourself out-loud,

“This is just a hurdle.

I will get past this.”

Life is not about how hard it is to get from one day to the next. It is about how we overcome unexpected challenges.

More Articles You May Be Interested In:

The Ultimate Guide To Budgeting

How a Grocery Price List Can Save You Money

Snowball vs Avalanche Budget Method

How Do I Get Out of Debit With Bad Credit

Resources For Further Research:

https://edu.gcfglobal.org/en/moneybasics/dealing-with-financial-anxiety/1/

https://www.helpguide.org/articles/stress/coping-with-financial-stress.htm

Subscribe and you'll receive our weekly posts right in your inbox. You'll also be one of the first to be notified when our free budget course opens. Hope to see you there!